Impact

Confidence in data quality

One validated golden dataset for all stakeholders and faster time to market of new use cases.

ETL processes demonstrably more efficient

Data processing more scalable

Daily mutations and growing data volumes remain manageable.

Governance and audit resilience

Clear ownership, traceable data and built-in controls. Less risk of capital tie-up: good for business.

About

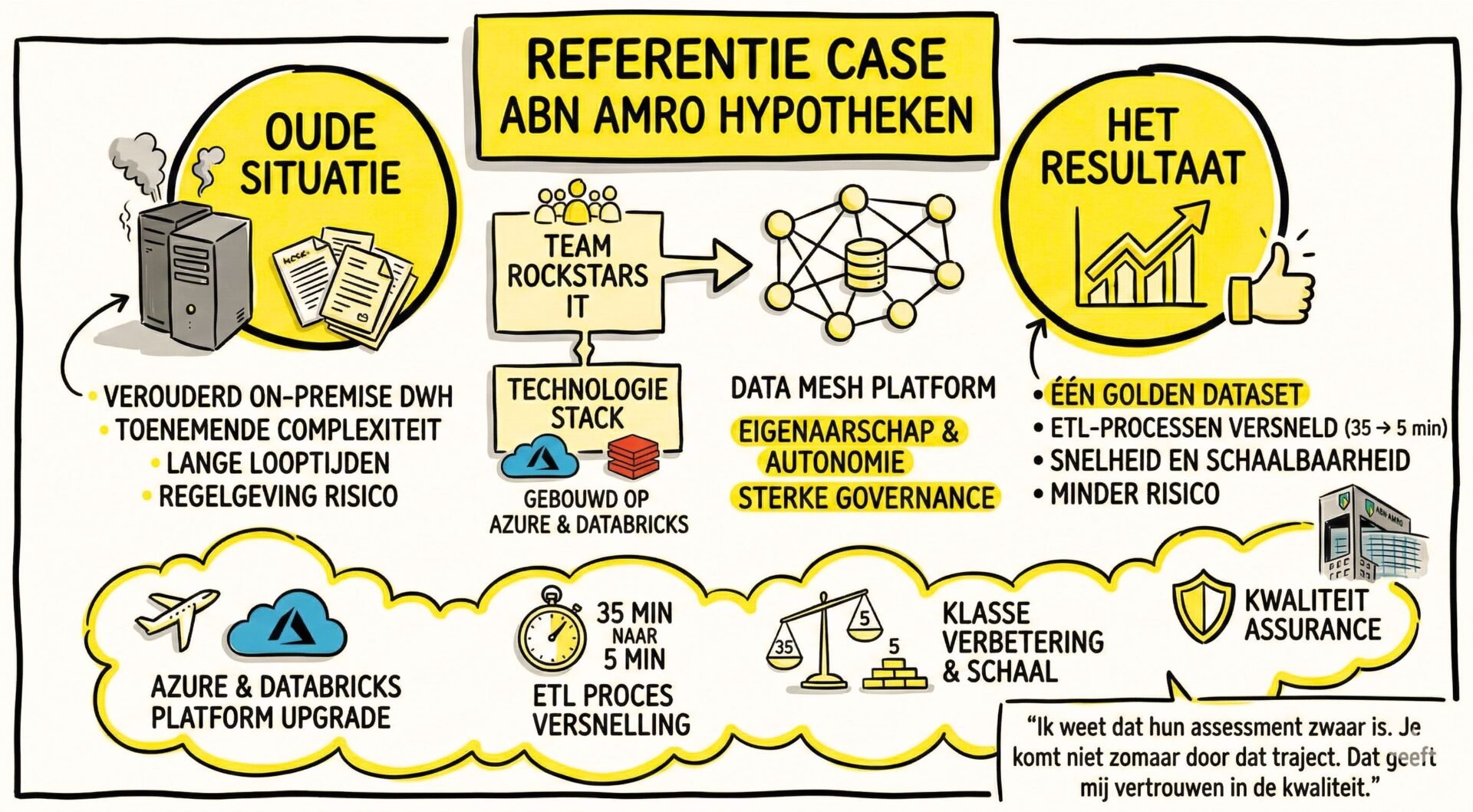

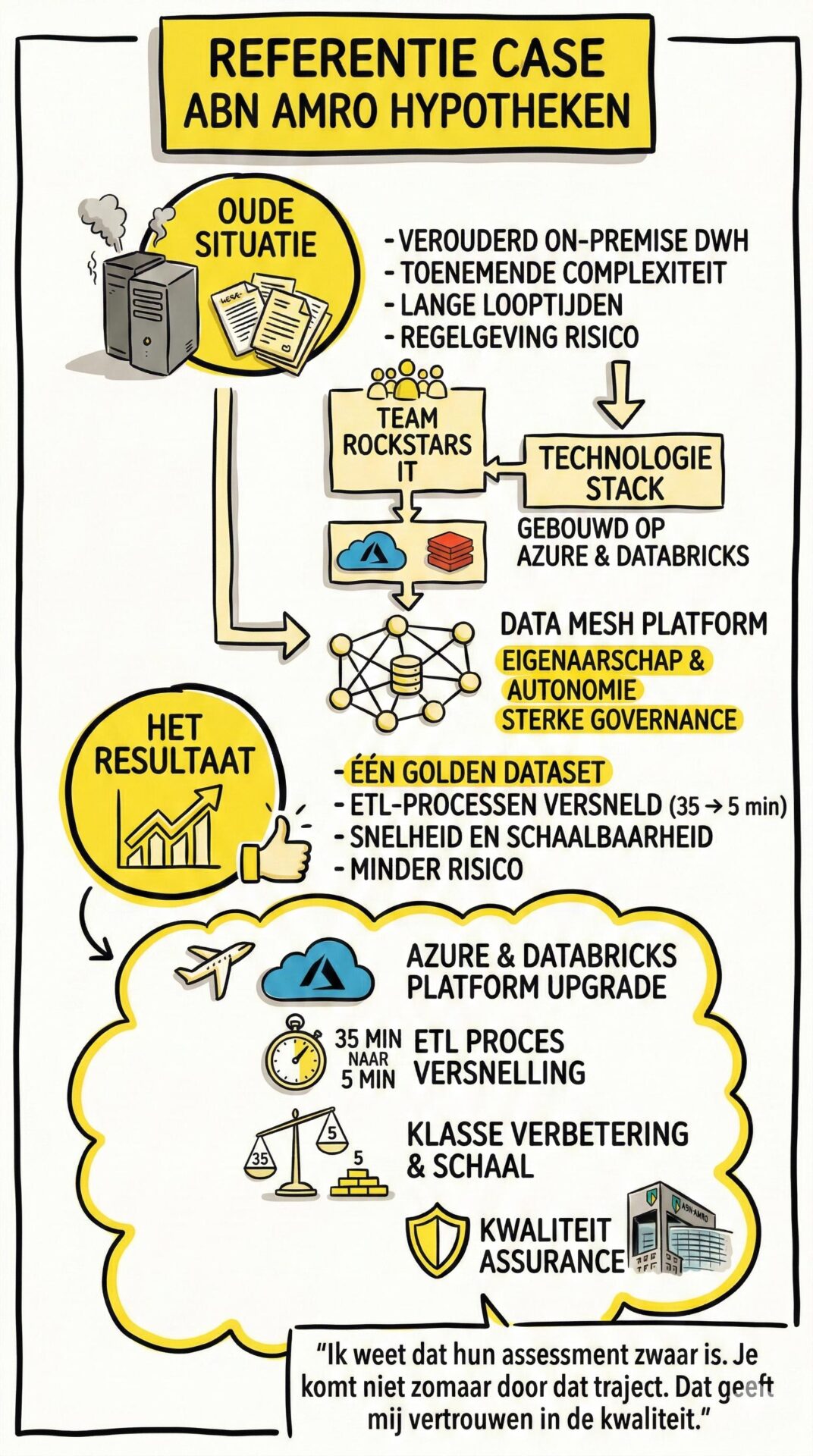

ABN AMRO Hypotheken is an independent subsidiary of ABN AMRO Bank and active in the Dutch mortgage market. Its ambition is clear: mortgages that move with life stages. From starter to move on. From family expansion to sustainability. This requires an organization that continuously adapts and improves.

Starting in 2026, the playing field shifts. ABN AMRO Mortgages will become part of the Bank. Not a change of direction, but a next step that sets new requirements. Connecting to bank-wide data standards, unambiguous definitions and robust governance becomes essential. Data is thus no longer supportive, but a strategic prerequisite. Not because it doesn’t work today, but because you have to be able to rely on it blindly tomorrow.

“We were not looking for extra capacity, but people who make our own people stronger. That’s exactly what Team Rockstars brings.”

Anticipating stricter requirements

The existing data warehouse supported growth for years, but complexity is increasing. Everything runs on-premises on SQL, lead times are increasing, and changes require more and more tuning. New laws and regulations are more difficult to process.

Marianne Pot, Head of Data Platform and Products at ABN AMRO Mortgages: “The old data warehouse was becoming increasingly complex.” In a banking context, that’s not a detail. Supervision is concrete, as are the consequences. “If you do nothing, you have to hold extra capital. That’s killing the business.”

Scale requires coherence

The role of data grew further: for reporting, decision-making, process optimization and future applications such as GenAI. That means more use and more intense collaboration within the Bank. But scale without coherence does not exist. Haime Croeze, Domain Architect Data at ABN AMRO: “Mortgages delivers data to the entire bank. That is only possible with unambiguous data and common rules.”

Autonomy with shared ground rules

Federated working became necessary. With the Federated Data Governance Model, teams manage their own data products, within shared standards for governance, definitions and access. The challenge: modernize while remaining robust, as integration with the Bank approached. Accelerating too soon was risky. Waiting too long, too.

From technology to trust

When Marianne Pot was commissioned to develop a new data platform, she joined the team. She joined Team Rockstars as a knowledge partner with a double mission: to add missing expertise and to leave internal teams stronger. Knowledge sharing became the modus operandi, via open sessions in which everyone contributes. “That is precisely what is interesting, because you don’t have all the wisdom,” says Marianne. Content carries more weight than job titles; ideas are allowed to rub off before they land.

A platform that grows with responsibility

Instead of a central data warehouse, ABN AMRO Hypotheken opted for a data mesh architecture. Rockstars contributed industry-leading expertise. The technical foundation consists of Azure Stack and Databricks, with Unity Catalog for governance and access management. PySpark provides efficient processing, which allowed data product teams to take ownership.

Erno Ledder, Rockstar and Data Engineer: “Through close contact with the teams and sharing insights, we arrived at the most efficient solution. Code is in one shared repository, so we avoid duplication and continuously improve.”

Space for investigative work

Governance was built in from the beginning. Teams were given room to experiment within clear frameworks, with collaboration and reuse as the norm. “Marianne gives us that space,” Erno said, and that had an immediate effect, including within GreenOps, where more efficient computer use and lower storage costs were realized. Even simple measures, such as archiving unused repositories, yielded quick results: about a ton a month in savings.

Team Rockstars acts as a catalyst. Not as extra capacity, but as a sharp sparring partner who asks questions, questions choices and transfers knowledge – so that what is built here, stays here.

Faster where you can, careful where you have to

Although still in development, the program already has clear strategic value. The proof of concept was successfully completed and given the green light to scale through with additional investment, despite bank-wide budget cuts. The results:

-

Scalable data processing Daily mutations and growing data volumes remain manageable.

-

Confidence in data quality Build new use cases on one golden dataset. No manual key work.

-

Faster ETL processes Critical load time reduced from 35 to 5 minutes, thanks to smarter code.

-

Robust governance Clear ownership, traceable data and built-in controls mitigate risk.

-

Shorter time-to-market Data product teams work independently within clear frameworks.

-

GreenOps impact More focused computing and lower storage costs.

-

Exemplary role within the Bank The Mortgages team is actively approached as an internal consultant.

About the impact, Haime Croeze is clear: “Broad-based confidence in our data quality is invaluable to the bank. The fact that that foundation is there is partly due to the cooperation with Team Rockstars.” What is being created here is not a project, but a foundation. Built with skill, fun and a shared belief that there is always room for improvement. Ready for the next phase of banking.

Collaboration

According to Marianne Pot, the partnership rests on shared principles, with people and learning at its core. “We were not looking for a supplier, but a partner who makes our people stronger. We found that match with Team Rockstars.” The professional assertiveness was appreciated in the process. “We Rockstars don’t settle for suboptimal solutions. That keeps everyone on their toes,” says Erno Ledder. Marianne adds: “Their sharp assessment gives me confidence in the quality.”

In addition to technical expertise, the collaboration stands out on three counts:

-

Cultural match People are visibly at one, just when things get exciting.

-

Knowledge Exchange Rockstars bring expertise and make sure it stays behind, while continuing to learn themselves.

-

Professional assertiveness They take initiative, question choices and continually seek better solutions.

Even during challenging periods, that match remained intact. “Openness and connection are at the core of our culture,” says Bart Nijskens, co-founder of Team Rockstars. Transparency and care for people were paramount, which further deepened trust.

In this way, both partners strengthen each other and quality is sustainably secured. Erno sums it up, “When teams make better decisions independently, you know you’ve got it down right.”

“Broad-based confidence in our data quality is invaluable to the bank. This is due in part to Team Rockstars”

Want to know more?

Please fill out the form below and a colleague will contact you as soon as possible.

Contact

"*" indicates required fields